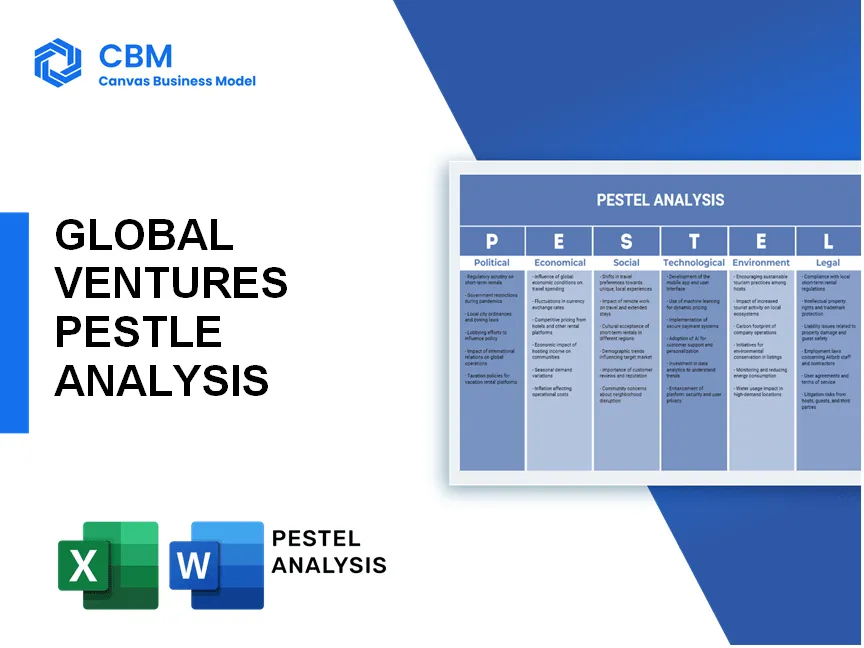

In a world where innovation knows no borders, Global Ventures thrives by navigating the vibrant landscapes of emerging markets. This UAE-based venture capital firm strategically invests in groundbreaking ideas, supported by a robust framework of political stability and economic dynamism. As we delve into the PESTLE analysis, uncover how political, economic, sociological, technological, legal, and environmental factors interplay to shape the investment horizon. Discover the intricate tapestry behind Global Ventures and the untapped potential waiting to be unleashed.

PESTLE Analysis: Political factors

UAE's stable political environment promotes investor confidence.

The United Arab Emirates (UAE) is known for its political stability, ranking 2nd in the Middle East and North Africa region, and 31st globally in the 2021 Global Peace Index. This stability is a significant factor for investor confidence, attracting over **$15 billion** in Foreign Direct Investment (FDI) in 2020.

Supportive government policies for venture capital and entrepreneurship.

The UAE government has introduced a series of policies aimed at fostering entrepreneurship and venture capital. For instance, in 2021, the Dubai Venture Capital Fund was launched with an investment of 1 billion AED to stimulate innovation and support startups. Additionally, the decision to allow 100% foreign ownership in certain sectors in 2021 has further encouraged investment.

Political relationships with emerging markets facilitate cross-border investments.

The UAE has established diplomatic ties with over 190 countries, enabling it to significantly impact cross-border investments. In 2022, trade between the UAE and emerging markets in Africa and Asia was worth around **$100 billion**. The Comprehensive Economic Partnership Agreements (CEPA) signed with countries like India and Indonesia in 2022 aim to boost bilateral trade.

Regulatory frameworks improving transparency in financial markets.

The UAE has made strides in enhancing its regulatory frameworks. The introduction of the UAE Commercial Companies Law in 2015 provided for clearer rules on corporate governance. The Securities and Commodities Authority (SCA) oversees the nation’s markets, aiming for compliance rates of over 95% for listed companies in regulatory disclosures.

Potential geopolitical risks in certain emerging markets.

While the UAE maintains a stable political environment, geopolitical risks exposure arises from investments in certain emerging markets. In 2021, the Global Terrorism Index rated countries like Afghanistan and Iraq with scores of **9.3** and **8.8** respectively, indicating high levels of insecurity. These risks necessitate thorough assessments for ventures targeting these markets.

| Political Factor | Description | Recent Data/Statistics |

|---|---|---|

| Political Stability | Strength of political institutions and absence of violence. | Global Peace Index Rank: 31st |

| FDI Inflow | Foreign Direct Investment attracted to the UAE. | $15 billion (2020) |

| Government Support | Investment in entrepreneurship and innovation funds. | 1 billion AED through Dubai Venture Capital Fund |

| International Trade | Trade volume with emerging markets. | $100 billion (2022) |

| SCA Compliance | Rate of compliance with financial regulations. | 95% compliance goal for listed companies |

| Geopolitical Risks | Risk levels in potential investment regions. | Global Terrorism Index: Afghanistan 9.3, Iraq 8.8 |

[cbm_pestel_top]

PESTLE Analysis: Economic factors

Rapid economic growth in various emerging markets creates investment opportunities.

The International Monetary Fund (IMF) projected that emerging markets and developing economies would grow at a rate of 4.5% in 2023. This growth rate indicates a substantial opportunity for venture capital investments, particularly in sectors such as technology, healthcare, and renewable energy.

Diversification of the UAE's economy enhances investment prospects.

The UAE’s non-oil sector has expanded significantly, contributing about 72.4% of GDP in 2021 compared to 65.3% in 2016. This indicates a growing emphasis on sectors like tourism and technology, providing a wider range of investment opportunities.

Interest rates and inflation rates impact investment valuations.

The Central Bank of the UAE has set the interest rate at 4.5%, after a series of increases throughout 2022 and 2023 to combat inflation, which was reported at 5.6% in 2022. Higher interest rates typically lead to decreased valuations for many startups seeking investment.

Currency fluctuations may affect returns on foreign investments.

The UAE dirham is pegged to the US dollar at a fixed rate of 3.67 dirhams per dollar. However, fluctuations in other currencies, such as the euro and the Indian rupee, can influence the returns on investments made in foreign markets.

Access to a growing pool of startups due to increased entrepreneurial activity.

According to the Dubai Startup Hub, there were over 1,150 active startups in the UAE as of 2023. This growth is supported by various programs and initiatives aimed at boosting entrepreneurship, thereby offering a fertile ground for venture capital investments.

| Economic Factor | Statistical Data | Impact on Investment |

|---|---|---|

| GDP Growth Rate of Emerging Markets | 4.5% (2023) | Increased investment opportunities |

| UAE Non-Oil Sector Contribution to GDP | 72.4% (2021) | Diversification in investment sectors |

| UAE Central Bank Interest Rate | 4.5% | Potential decrease in startup valuations |

| UAE Inflation Rate | 5.6% (2022) | Impact on purchasing power |

| Number of Active Startups in UAE | 1,150 (2023) | Increased access to investment opportunities |

PESTLE Analysis: Social factors

Sociological

The rising youth population in emerging markets significantly contributes to innovation and technology adoption. In 2023, approximately 60% of the population in the Middle East and North Africa (MENA) region is under the age of 30, driving demand for tech-savvy solutions.

Cultural acceptance of entrepreneurship is increasing in several regions; for instance, in the UAE, the Global Entrepreneurship Monitor reported that 83% of the population views entrepreneurship as a desirable career choice in 2022.

Social media trends greatly influence consumer behavior and startup success; research shows that 75% of Middle Eastern consumers have engaged with brands via social media in the past year. Platforms like Instagram and TikTok are pivotal in reaching target audiences.

There is a growing need for social impact investments in underserved communities. In 2021, the total global impact investing market was valued at around $715 billion, with a projected growth reaching $1 trillion by 2025, demonstrating the increasing focus on social responsibility.

Changing lifestyles and preferences create new market opportunities. According to a 2022 report by Statista, e-commerce sales in the UAE are expected to surpass $27 billion by 2025, driven by shifts toward digital shopping experiences.

| Factor | Current Statistics | Forecasts |

|---|---|---|

| Youth Population in MENA | Approx. 60% under age 30 | Continued growth projected through 2030 |

| Entrepreneurship Acceptance (UAE) | 83% view entrepreneurship as desirable | Expected increase in startups by 30% by 2025 |

| Social Media Engagement (MENA) | 75% engaged with brands | Growth in digital engagement expected |

| Global Impact Investing Market | Valued at approx. $715 billion | Projected to reach $1 trillion by 2025 |

| E-commerce Sales in UAE | Estimated at $27 billion by 2025 | Continuously expanding due to digital trends |

PESTLE Analysis: Technological factors

Growing digital infrastructure in emerging markets supports startup growth.

The ongoing development of digital infrastructure in emerging markets is pivotal for the growth of startups. As of 2022, the global digital economy reached approximately $11.5 trillion, and it is expected to expand at a CAGR of half to 20% by 2025. In regions like Sub-Saharan Africa, internet penetration increased from 7% in 2000 to over 26% in 2022, creating a fertile ground for tech-driven companies.

| Region | Internet Penetration (%) 2022 | Digital Economy Size (USD) 2022 | Projected CAGR (2023-2025) |

|---|---|---|---|

| Sub-Saharan Africa | 26 | USD 115 billion | 20% |

| Latin America | 69 | USD 390 billion | 13% |

| Middle East | 67 | USD 56 billion | 14% |

Advancements in fintech provide new avenues for investment.

Fintech is at the forefront of investment opportunities. The global fintech market size was valued at $110 billion in 2021 and is projected to expand at a CAGR of 23.84%, reaching approximately $510 billion by 2028. Notably, the Middle East fintech investments increased from $300 million in 2017 to over $1 billion in 2021.

Rising demand for tech-driven solutions across various sectors.

Tech-driven solutions are increasingly sought after across multiple sectors. As of 2023, the AI market alone is projected to reach $190 billion, along with the cloud computing market expected to hit $800 billion by 2025. This rise represents a significant opportunity for investors targeting startups in these areas.

Importance of cybersecurity and data privacy initiatives.

The surge in digital operations emphasizes the importance of cybersecurity. Global spending on cybersecurity products and services was projected to exceed $202 billion in 2024, up from $114 billion in 2020. Moreover, around 39% of companies experienced data breaches that could have been prevented with better cybersecurity measures in place.

Collaboration with tech companies enhances investment strategies.

Strategic partnerships with tech companies are becoming essential for investment firms. Approximately 70% of venture capitalists believe that collaborating with established tech firms can significantly boost their portfolio performance. Accenture reported that about 68% of investors chose tech collaborations to improve the scalability of their investments.

| Collaboration Type | % of Investors Engaged | Portfolio Performance Improvement (%) |

|---|---|---|

| Partnerships | 70 | 30 |

| Joint Ventures | 65 | 25 |

| Consulting Arrangements | 45 | 15 |

PESTLE Analysis: Legal factors

Evolving regulatory landscape for venture capital in the UAE

The venture capital landscape in the UAE is increasingly shaped by new regulations aimed at fostering innovation and entrepreneurship. In 2021, the UAE implemented the Commercial Companies Law, which allows 100% foreign ownership in certain sectors. As of 2022, the UAE had over 250 active venture capital firms, with regulatory bodies such as the Dubai Financial Services Authority (DFSA) and the Financial Conduct Authority (FCA) overseeing compliance.

| Year | Active Venture Capital Firms | Total Investment (USD Billion) |

|---|---|---|

| 2020 | 180 | 1.1 |

| 2021 | 210 | 1.5 |

| 2022 | 250 | 2.1 |

Importance of intellectual property protection for startups

Intellectual property (IP) protection is crucial for startups in the UAE, where IP-related cases have increased by 30% from 2020 to 2022. The United Arab Emirates Federal Law No. 36 of 2021 on copyrights and related rights provides a legal framework for the protection of creative works. Approximately 60% of startups consider IP as a major factor in their business strategy.

Compliance with international investment laws is essential

Compliance with international investment laws, including the OECD Guidelines for Multinational Enterprises, is key for firms like Global Ventures. In 2022, the UAE’s overall compliance with international standards marked an increase of 15% from previous years. The UAE ranks 8th globally in terms of investment attractiveness, reflecting its commitment to providing a stable legal framework for investors.

Variability in legal frameworks among emerging markets creates challenges

Emerging markets often have varying legal frameworks that can complicate investment efforts. For instance, navigating regulations in countries such as India, Egypt, and Vietnam presents challenges due to differing levels of enforcement and regulatory standards. According to a survey by the World Bank, 47% of venture capitalists cited legal and regulatory risks as significant barriers to investment in emerging markets in 2023.

Need for due diligence to navigate legal risks effectively

Conducting due diligence is essential for managing legal risks in venture capital investments. Investor compliance costs can range between 5% to 10% of total investment in due diligence, which often totals $50,000 to $100,000 per transaction. In 2022, a notable 75% of VC firms reported that thorough due diligence processes have helped mitigate legal disputes in their portfolios.

PESTLE Analysis: Environmental factors

Increasing focus on sustainable investments and ESG criteria

As of 2023, the global sustainable investment market reached approximately $35 trillion, accounting for over 36% of total assets under management. Among these, investments adhering to Environmental, Social, and Governance (ESG) criteria are notably prioritized by institutional investors.

Regulatory pressures for environmentally-friendly practices in business

In the UAE, the government has implemented various regulations aimed at enhancing environmental sustainability, such as the UAE Vision 2021, which aims to reduce carbon emissions by 30% by 2030. Furthermore, in 2022, Dubai launched the Dubai Green Initiative targeting to achieve 100% clean energy by 2050.

Potential for renewable energy investments in emerging markets

According to the International Renewable Energy Agency (IRENA), renewable energy investments in emerging markets are projected to reach up to $25 trillion by 2030. The share of renewables in energy generation for emerging economies surpassed 30% in 2023, indicating a significant increase from previous years.

Climate change risks impacting long-term investment viability

Mitigating climate change is a pressing concern, with the projected economic costs of climate change reaching $2.5 trillion per year by 2040 if no substantial action is taken. The World Economic Forum reports that 60% of CEOs view climate change as a significant threat to their business viability.

Growing awareness of the importance of environmental stewardship in entrepreneurship

Recent surveys indicate that 77% of millennials prefer to work for environmentally responsible companies. Moreover, entrepreneurs increasingly acknowledge that businesses with robust environmental stewardship can achieve profitability, with studies showing that companies adopting sustainable practices may experience a revenue growth of 10-20%.

| Factor | Current Statistics | Future Projections |

|---|---|---|

| Sustainable Investment Market | $35 trillion (2023) | $50 trillion by 2025 (Projected) |

| UAE Carbon Emission Reduction Target | 30% by 2030 | 100% Clean Energy by 2050 (Dubai Green Initiative) |

| Renewable Energy Investment (Emerging Markets) | $25 trillion by 2030 (Projected) | $30 trillion by 2035 (Projected) |

| Economic Costs of Climate Change | $2.5 trillion per year by 2040 | Potentially $4 trillion by 2050 (Projected) |

| Millennials' Preference for Green Companies | 77% | 85% by 2025 (Projected) |

In embarking on the journey of investment through the lens of Global Ventures, understanding the complex interplay of political, economic, sociological, technological, legal, and environmental factors is crucial. Each aspect unveils unique opportunities and challenges in the vibrant landscape of emerging markets. As we navigate this multifaceted environment, strategic insights derived from comprehensive PESTLE analysis can empower investors to make informed decisions, fostering innovation and sustainable growth in a rapidly evolving world.

[cbm_pestel_bottom]