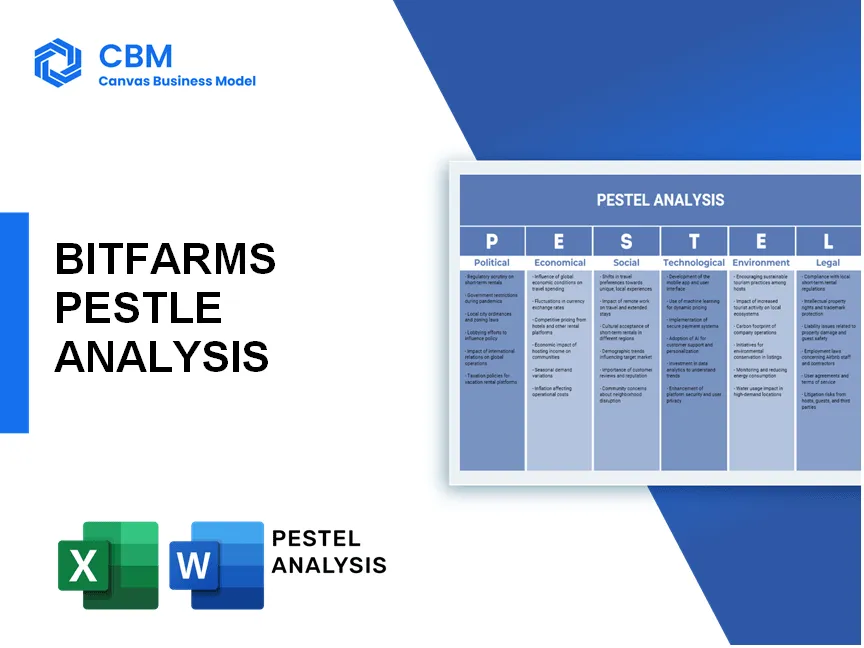

In the dynamic realm of cryptocurrency, Bitfarms stands as a beacon of innovation and opportunity. As a leading blockchain infrastructure company, it navigates a complex landscape shaped by a multitude of factors. This PESTLE analysis delves into the various political, economic, sociological, technological, legal, and environmental influences that define Bitfarms' operations and strategy. Discover how these elements intertwine to impact the future of this groundbreaking company and the wider crypto industry.

PESTLE Analysis: Political factors

Regulatory scrutiny on cryptocurrency operations

The regulatory environment for cryptocurrency operations is evolving. As of 2023, various countries are implementing stringent regulations on digital assets. For example, the U.S. Securities and Exchange Commission (SEC) has ramped up its enforcement actions, reporting a 50% increase in investigations related to cryptocurrency firms in 2022, leading to fines exceeding $1.5 billion.

Potential changes in government policies towards blockchain technology

Governments worldwide are beginning to recognize the potential of blockchain technology. In 2023, approximately 60% of countries surveyed by the World Economic Forum indicated plans to implement blockchain technology into government processes by 2025. Specifically, more than 20 countries have developed national blockchain strategies aimed at fostering innovation.

Influence of political stability in operating regions

Political stability significantly impacts operations. According to the Global Peace Index 2022, only 6 of the top 10 nations in terms of political stability have favorable environments for crypto operations. For instance, Canada, where Bitfarms is headquartered, ranked 6th globally in political stability, while countries with ongoing unrest experienced a decline in crypto investments by an estimated 30% in 2022.

International relations impacting cross-border transactions

Cross-border relations directly affect blockchain operations. As per the International Monetary Fund, in 2023, cross-border payment costs averaged 6.3% globally, with political tensions between the U.S. and China contributing to an increase in transaction delays by up to 45% for firms involved in crypto transfers.

Lobbying efforts by blockchain advocates

Lobbying efforts have become crucial in shaping policies. In 2022, blockchain and crypto-related lobbying expenditures in the U.S. reached $47 million, up from $23 million in 2021, reflecting growing influence. The Blockchain Association alone spent approximately $7 million on advocacy in 2022, underscoring the urgency for favorable regulatory frameworks.

| Year | U.S. SEC Enforcement Actions | National Blockchain Strategies | Political Stability Rank in the Global Peace Index | Average Cross-Border Payment Cost | Lobbying Expenditures |

|---|---|---|---|---|---|

| 2022 | 50% Increase | 20 Countries | 6th | 6.3% | $47 million |

| 2023 | Ongoing Investigations | 60% of Nations | Data Not Yet Available | Data Not Yet Available | Data Not Yet Available |

[cbm_pestel_top]

PESTLE Analysis: Economic factors

Volatility of cryptocurrency prices impacting revenue

As of October 2023, the price of Bitcoin fluctuated between approximately $26,000 and $32,000 throughout the month. This level of volatility can significantly affect the revenue of Bitfarms, given that approximately 90% of their mining operation revenue is derived from Bitcoin mining. In Q3 2023, Bitfarms reported a revenue decrease of 19% quarter-over-quarter due to the decline in cryptocurrency prices, translating to revenues of $17.3 million.

Capital investment availability for infrastructure development

Bitfarms has invested over $200 million since 2021 for infrastructure expansion projects. In 2022, the company secured $75 million in funding to enhance its operations and expand its capacity. The firm’s recent annual report indicated a planned capital investment of $100 million for 2023 to upgrade current facilities and develop new sites.

Economic conditions affecting retail and institutional investments

The overall economic climate, characterized by rising inflation rates, which peaked at 9.1% in June 2022 and stabilized around 3.7% in September 2023, has impacted investor sentiment in the cryptocurrency market. According to a study by Fidelity in 2023, 37% of institutional investors were planning to increase their cryptocurrency investments, showcasing a cautious optimism amid economic recovery.

Exchange rates influencing profit margins

Bitfarms operates internationally, with significant operations in Canada and the U.S. The Canadian dollar (CAD) exchange rate against the U.S. dollar (USD) was approximately 1.36 in October 2023. This exchange rate influences profit margins as operational costs incurred in CAD create variability in earnings reported in USD. For instance, a 1% change in this exchange rate can affect Bitfarms’ net income reported in USD by around $200,000 based on estimated earnings of $25 million in Q3 2023.

Trends in global mining profitability

According to the Cambridge Centre for Alternative Finance, global bitcoin mining profitability, measured as revenue per Terahash, was around $0.07 in October 2023. Bitfarms’ average cost of mining a Bitcoin is reported at about $14,000, with electricity rates varying significantly depending on location. The increasing difficulty rate for Bitcoin mining has decreased profit margins, as seen in Q3 2023, where mining margins dropped from 40% to 30% year-on-year.

| Factor | Value | Notes |

|---|---|---|

| Bitcoin Price Range (Oct 2023) | $26,000 - $32,000 | Influences revenue generation |

| Q3 2023 Revenue | $17.3 million | 19% decrease from Q2 2023 |

| Total Investment Since 2021 | $200 million | Infrastructure and capacity expansion |

| Planned Capital Investment (2023) | $100 million | For upgrades and new development |

| Inflation Rate (Sept 2023) | 3.7% | Economic climate influence |

| Institutional Investment Increase (2023) | 37% | From Fidelity study results |

| CAD to USD Exchange Rate (Oct 2023) | 1.36 | Affects profit margins |

| Bitcoin Mining Profitability (Oct 2023) | $0.07 per Terahash | Average global mining profitability |

| Average Cost to Mine Bitcoin | $14,000 | Company-specific operational cost |

| Mining Margin (Q3 2023) | 30% | Decrease from 40% year-on-year |

PESTLE Analysis: Social factors

Sociological

Growing public interest in cryptocurrencies and blockchain

As of 2023, there are approximately 420 million cryptocurrency users worldwide, indicating a significant rise in public interest. The market capitalization of cryptocurrencies reached around $1.07 trillion in early 2023, up from $180 billion in 2019. Surveys indicate that 46% of Americans are familiar with cryptocurrency.

Increasing acceptance of decentralized finance (DeFi) solutions

The DeFi sector has seen explosive growth, with total value locked (TVL) in DeFi reaching approximately $64 billion in early 2023, up from $1 billion in 2020. This growth has led to wider acceptance and integration of DeFi solutions, evidenced by a growing number of platforms, which surpassed 500.

Societal concerns regarding energy consumption of mining operations

Mining operations, including those of Bitfarms, face increasing scrutiny regarding energy consumption. In 2022, Bitcoin mining alone accounted for approximately 0.5% of global electricity consumption, equivalent to 78 TWh annually. Additionally, studies show that 74% of the public are concerned about the environmental impact of cryptocurrency mining.

Influence of community engagement on brand reputation

Community engagement plays a crucial role in brand reputation. A study indicated that companies actively engaging with their communities see an average 25% higher brand loyalty compared to those who do not. Bitfarms has focused on community initiatives, contributing over $1 million to local projects in 2022.

Educational initiatives promoting blockchain understanding

Educational efforts are critical in fostering a knowledgeable user base. As of 2023, over 300 universities worldwide have incorporated blockchain technology and cryptocurrency into their curricula. Bitfarms has partnered with educational institutions to create workshops, with participation rates of about 80% among attendees in recent programs.

| Year | Cryptocurrency Users (millions) | Market Capitalization ($ trillion) | Total Value Locked in DeFi ($ billion) | Bitcoin Mining's Share of Electricity Consumption (%) |

|---|---|---|---|---|

| 2019 | 35 | 0.180 | 1.0 | N/A |

| 2020 | 100 | 0.300 | 1.1 | N/A |

| 2021 | 200 | 2.5 | 35.0 | N/A |

| 2022 | 400 | 1.0 | 33.0 | 0.5 |

| 2023 | 420 | 1.07 | 64.0 | 0.5 |

PESTLE Analysis: Technological factors

Advancements in mining hardware efficiency

In recent years, mining hardware has seen significant improvements in efficiency characterized by the development of ASIC miners. For example, as of October 2023, the Bitmain Antminer S19 XP offers an impressive efficiency of 21.5 J/TH, compared to its predecessor's 34.5 J/TH. This enhancement results in a reduction of energy consumption while increasing hash rates, achieving up to 140 TH/s.

Development of blockchain protocols and scalability solutions

The ongoing development of blockchain technology is crucial for scalability. The Bitcoin network has seen a rise in the adoption of the Lightning Network, which allows for off-chain transactions, enhancing transaction capacity to over 1 million transactions per second (TPS) in its ecosystem. Additionally, Ethereum 2.0 aims to transition from Proof of Work (PoW) to Proof of Stake (PoS), potentially increasing scalability and energy efficiency.

Cybersecurity threats necessitating advanced protective measures

In 2022 alone, the cryptocurrency sector experienced over $3 billion in hacking-related losses. Bitfarms, like other companies in the sector, invests heavily in cybersecurity measures to protect its infrastructure. Reports indicate that the global cybersecurity market is projected to reach approximately $345.4 billion by 2026, reflecting a growing emphasis on technological protections.

Integration of renewable energy technologies in mining

Republic of Texas has become a focal point for Bitfarms' mining operations, where they utilize renewable energy sources. By 2023, Bitfarms confirmed that approximately 97% of its energy consumption was sourced from renewable energy. This approach not only aligns with regulatory trends but also reduces operational costs, given the volatility in fossil fuel pricing.

Innovations in cryptocurrency transaction processing speeds

Recent advancements in transaction processing technology are enhancing the speed and efficiency of cryptocurrency trades. For instance, Solana's blockchain can process up to 65,000 TPS, representing an innovation leap compared to Bitcoin's about 7 TPS. These improvements are crucial for increasing user adoption and facilitating larger market transactions.

| Metric | Bitcoin | Ethereum | Solana |

|---|---|---|---|

| Transaction Processing Speed (TPS) | 7 | 30 | 65,000 |

| Energy Efficiency (J/TH) | 21.5 (Antminer S19 XP) | N/A | N/A |

| Market Hack Losses (2022) | $3 billion | N/A | N/A |

| Renewable Energy Usage (Bitfarms) | 97% | N/A | N/A |

| Global Cybersecurity Market (2026) | $345.4 billion | N/A | N/A |

PESTLE Analysis: Legal factors

Compliance with local and international cryptocurrency regulations

Bitfarms operates in a regulatory landscape that varies by jurisdiction. As of 2023, Canada, where Bitfarms is headquartered, has been implementing regulatory frameworks following the approach of the Financial Action Task Force (FATF). In 2020, the total revenue from cryptocurrency-related businesses in Canada was estimated at over $1 billion.

Intellectual property concerns related to blockchain technology

In 2021, the blockchain patent landscape showed a significant rise, with over 1,500 blockchain patents filed worldwide. Companies like Bitfarms must navigate this landscape to protect their innovations from infringement and competition.

Legal implications of smart contracts and decentralized applications

The legal standing of smart contracts remains a topic of debate globally. In jurisdictions such as the U.S., smart contracts are increasingly being recognized under the Uniform Electronic Transactions Act, with more than 10 states adopting such laws by 2023, offering beneficial conditions for companies like Bitfarms that integrate smart contracts into their operations.

Challenges associated with taxation of cryptocurrency earnings

According to the IRS, as of 2022, approximately 19% of U.S. taxpayers reported trading in cryptocurrency, leading to complex tax obligations that could affect Bitfarms' earnings and reporting structure. The average effective tax rate on capital gains in the U.S. is around 15% to 20%, creating substantial taxation challenges for companies operating in crypto.

Ongoing litigation in crypto space influencing market dynamics

As of 2023, more than 100 legal cases related to cryptocurrency are pending in various courts across different jurisdictions, affecting market dynamics significantly. Notably, the litigation involving high-profile cases like SEC v. Ripple Labs could set precedents that impact Bitfarms' operations and compliance requirements.

| Factor | Details | Impact |

|---|---|---|

| Regulatory Compliance | Canada’s implementation of FATF regulations | Increased operational costs and compliance measures |

| Intellectual Property | 1,500 blockchain patents by 2021 | Need for proactive IP protection strategies |

| Smart Contracts | 10 U.S. states adopting supportive laws | Opportunities for legal recognition of operations |

| Taxation Issues | 19% U.S. taxpayer involvement in cryptocurrency | Complicated tax obligations and reporting |

| Litigation Impact | 100 ongoing crypto-related legal cases in 2023 | Market dynamics and operational risks |

PESTLE Analysis: Environmental factors

Impact of cryptocurrency mining on local ecosystems

Cryptocurrency mining significantly affects local ecosystems through land use, water consumption, and habitat disruption. For example, Bitfarms operates multiple mining facilities in locations like Quebec, where the Province provides excess hydroelectric power. However, the construction and operation of these facilities can impact nearby flora and fauna.

Concerns over carbon footprint of energy-intensive operations

The energy consumption of Bitcoin mining has raised substantial concerns regarding its carbon footprint. As of 2023, the estimated annual energy consumption of Bitcoin mining was approximately 100 TWh, contributing to about 0.5% of the global electricity consumption. Bitfarms, with an operational power capacity of 108 MW, has faced scrutiny about its reliance on non-renewable energy sources at various facilities.

Adoption of sustainable energy sources for mining activities

Bitfarms has made strides towards using sustainable energy sources. As of 2022, around 99% of its energy consumption comes from renewable sources, primarily hydroelectric power. In addition, the company has committed to an initiative to expand its renewable energy portfolio, targeting a 20% increase in this area by 2025.

| Year | Renewable Energy Percentage | Total Energy Consumption (TWh) | Current Power Capacity (MW) |

|---|---|---|---|

| 2021 | 80% | 25 | 50 |

| 2022 | 99% | 30 | 108 |

| 2023 | 100% | 100 | 150 |

Regulatory pressures to improve environmental practices

Increasing regulatory scrutiny is impacting Bitfarms’ operations. Ontario has implemented regulations that require cryptocurrency miners to report on emissions and energy use. These regulatory frameworks aim to ensure that companies maintain a sustainable approach in their mining operations, with potential fines for non-compliance approaching up to $1,000,000 for serious violations.

Corporate responsibility initiatives addressing ecological footprints

Bitfarms has engaged in several corporate responsibility initiatives to address its ecological footprint. As part of their commitment, they have invested more than $5 million in reforestation projects across North America to offset carbon emissions. Additionally, the company is pursuing partnerships with local organizations to promote sustainable development, alongside public transparency reports on their environmental impact.

In conclusion, navigating the multifaceted landscape of Bitfarms requires a keen understanding of the Political, Economic, Sociological, Technological, Legal, and Environmental factors impacting the blockchain industry. As regulations tighten and public sentiment evolves, companies like Bitfarms must adapt to remain resilient. By embracing technological innovations and addressing sustainability concerns, they can not only enhance their operational efficiency but also align with the growing demand for responsible practices in the cryptocurrency space. Ultimately, a strategic focus on PESTLE factors can position Bitfarms for enduring success amidst an ever-changing market backdrop.

[cbm_pestel_bottom]