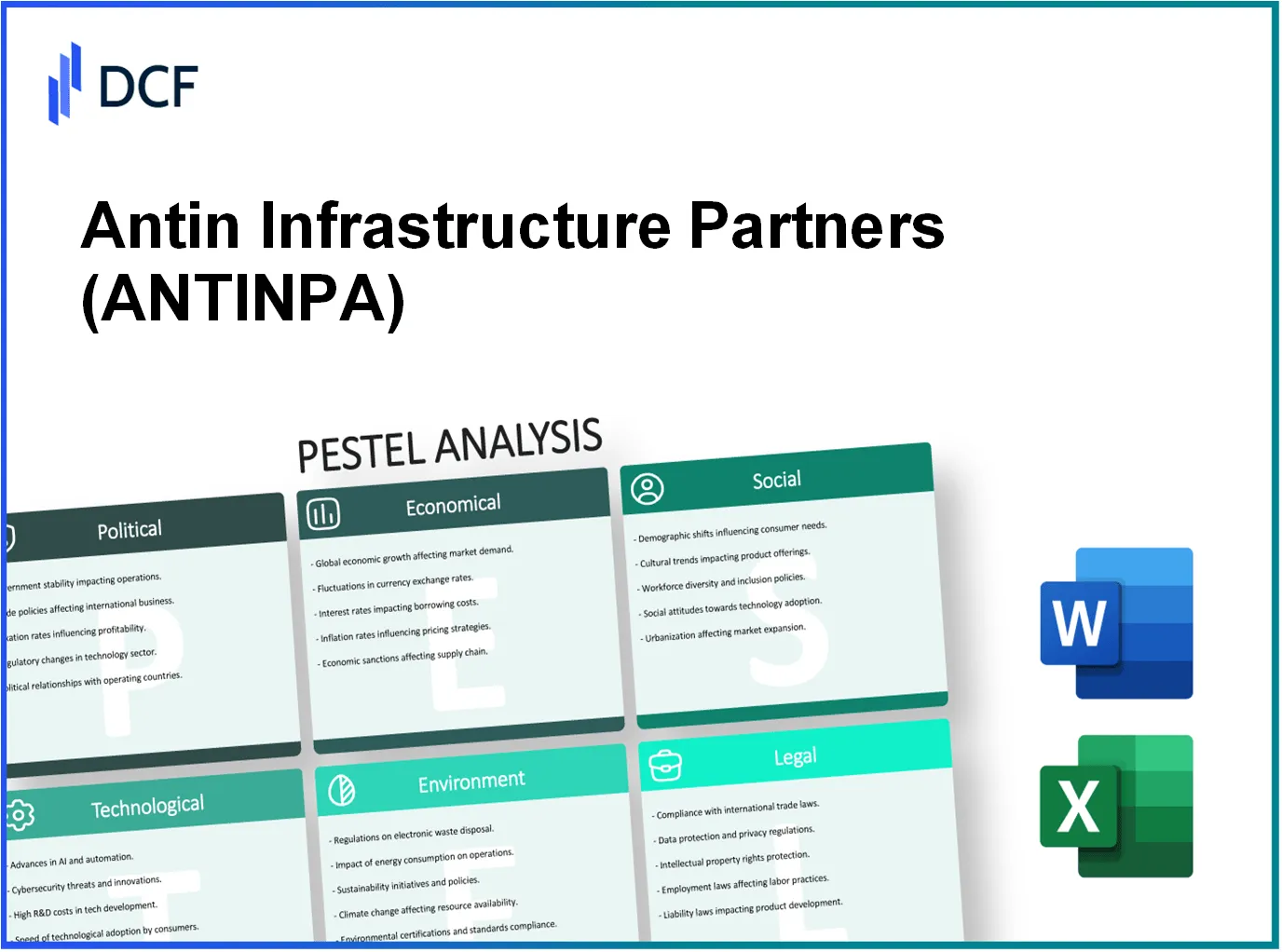

In a rapidly evolving landscape, Antin Infrastructure Partners S.A. navigates a complex web of political, economic, sociological, technological, legal, and environmental factors that shape its operations and growth potential. Understanding these elements through a PESTLE analysis reveals not only the challenges but also the opportunities that lie ahead for this infrastructure powerhouse. Dive deeper to explore how these dynamics influence Antin's strategic decisions and market positioning.

Antin Infrastructure Partners S.A. - PESTLE Analysis: Political factors

Regulatory stability in the EU plays a significant role for Antin Infrastructure Partners. The European Union's regulatory framework has demonstrated a relatively stable environment for investment in infrastructure projects. As of 2023, the EU's investment in infrastructure reached approximately €650 billion under the Next Generation EU recovery plan, indicating strong political will to enhance infrastructure resilience. Furthermore, according to the European Commission, the EU aims to invest about €400 billion annually in infrastructure by 2027, bolstered by various guidelines and regulations aimed at smoothing the investment process.

Influence of EU infrastructure policies is also a critical consideration. Initiatives like the European Green Deal and the Connecting Europe Facility (CEF) are examples of policies that directly impact Antin's operations. CEF is set to provide around €30 billion between 2021 and 2027 to improve cross-border infrastructure, especially in energy, transport, and digital sectors. These policies encourage investment in green and sustainable projects, aligning with Antin's focus on renewable energy and sustainable infrastructure.

Political relations impacting cross-border projects are vital for Antin, particularly due to the firm’s portfolio, which includes international assets. Political stability in the EU has resulted in favorable conditions for cross-border investments, especially within the European Economic Area (EEA). The European Market Infrastructure Regulation (EMIR) and the Capital Requirements Directive (CRD) are instrumental in fostering trust and stability. Recent data indicates that cross-border infrastructure investments in Europe have grown by 25% from 2020 to 2022, showcasing the positive impact of conducive political relations.

Public-private partnership support is a key factor in facilitating infrastructure projects in which Antin engages. The EU has identified PPPs as essential to achieving its infrastructure goals. In 2022, approximately €100 billion was mobilized through PPPs for infrastructure investments in Europe, underscoring the role of private firms in public projects. Antin benefits from this trend as it actively participates in PPP arrangements, leveraging public funding to mitigate risks and enhance project viability.

| Political Factor | Details | Impact on Antin |

|---|---|---|

| Regulatory Stability | €650 billion investment under Next Generation EU. | Favors long-term investment strategies. |

| EU Infrastructure Policies | €30 billion from Connecting Europe Facility (2021-2027). | Encourages sustainable infrastructure projects. |

| Political Relations | 25% growth in cross-border investments (2020-2022). | Enhances opportunities for international expansion. |

| Public-Private Partnership | €100 billion mobilized through PPPs in 2022. | Provides risk mitigation and funding access. |

Antin Infrastructure Partners S.A. - PESTLE Analysis: Economic factors

Fluctuations in construction costs have a direct impact on the profitability of Antin Infrastructure Partners. According to the Turner Construction Company’s Cost Index, construction costs increased by approximately 5.9% in 2021 and projected to rise by 4.5% in 2022. These increases can lead to higher expenses for projects in their portfolio, affecting overall returns.

Moreover, the Producer Price Index (PPI) for construction materials rose by 14.8% year-over-year in 2022, showcasing significant cost pressures that can affect project budgets and margins.

Interest rate variations affecting financing are crucial for Antin's operational strategy. As of late 2023, the Federal Reserve’s interest rate stands at 5.25% to 5.50%. Higher interest rates increase the cost of borrowing, which can slow down investment in infrastructure projects. Based on data from the Bank for International Settlements, a 1% increase in interest rates can reduce project financing attractiveness by approximately 10%.

Economic growth driving infrastructure demand remains a significant factor in Antin’s business model. The International Monetary Fund (IMF) projected global GDP growth to reach 3.0% in 2023, with developed economies like the U.S. expecting 2.1% growth. This growth trajectory typically correlates with increased expenditure on infrastructure, which creates a favorable environment for Antin. The European Investment Bank's Infrastructure Report indicated that infrastructure spending in Europe could exceed €3 trillion by 2030, driven by recovery from the COVID-19 pandemic and green transition initiatives.

Availability of funding for large projects is critical for Antin’s operations. In 2022, global infrastructure investment reached around $1.3 trillion. The World Bank estimated that an annual investment increase of $3.7 trillion is required to meet the global infrastructure needs by 2035. Public-private partnerships (PPPs) are becoming a more common funding mechanism, with the OECD reporting that around 50% of new projects in developed countries utilize this model, reflecting a shift towards innovative funding solutions.

| Year | Construction Cost Increase (%) | PPI for Construction Materials Increase (%) | Federal Reserve Interest Rate (%) | Global GDP Growth (%) | Global Infrastructure Investment ($ Trillions) |

|---|---|---|---|---|---|

| 2021 | 5.9 | N/A | N/A | N/A | N/A |

| 2022 | 4.5 | 14.8 | N/A | N/A | 1.3 |

| 2023 | N/A | N/A | 5.25 - 5.50 | 3.0 | N/A |

| 2030 (Projected) | N/A | N/A | N/A | N/A | 3.0 |

Antin Infrastructure Partners S.A. - PESTLE Analysis: Social factors

Urbanization trends are significantly reshaping the landscape of infrastructure needs. As of 2023, the World Bank reported that approximately 56% of the global population resides in urban areas, a figure projected to increase to 68% by 2050. This rapid urbanization is driving demand for robust infrastructure solutions, including transportation, energy, and water services.

Public opposition to certain infrastructure projects can substantially affect their execution and viability. A notable case is the opposition faced by the proposed High-Speed 2 (HS2) railway project in the UK, where local communities and environmental groups raised concerns. As of early 2023, the project's estimated budget has ballooned to £98 billion, reflecting the financial and social complexities involved in infrastructure development.

Demographic shifts are also impacting project prioritization. According to the United Nations, by 2030, the number of people aged 60 years and older is expected to reach 1.4 billion, necessitating infrastructure that caters to an aging population. This demographic change demands enhanced accessibility and healthcare facilities, influencing investment strategies in the infrastructure sector.

Social acceptance of sustainable infrastructure is becoming increasingly critical. A 2022 survey by Deloitte indicated that 70% of respondents believed that government policies should prioritize sustainable infrastructure investments. The European Commission's commitment to the Green Deal also emphasizes a shift towards sustainable projects, aiming for 55% reduction in greenhouse gas emissions by 2030.

| Trend | Statistic | Year |

|---|---|---|

| Urban Population Growth | 56% of global population | 2023 |

| Projected Urbanization by 2050 | 68% of global population | 2050 |

| HS2 Project Cost | £98 billion | 2023 |

| Aging Population (60 years) | 1.4 billion | 2030 |

| Public Support for Sustainable Infrastructure | 70% support | 2022 |

| Greenhouse Gas Emission Reduction Goal | 55% by 2030 | 2030 |

Antin Infrastructure Partners S.A. - PESTLE Analysis: Technological factors

Antin Infrastructure Partners S.A. is deeply invested in the adoption of smart infrastructure technologies. The global smart infrastructure market is projected to grow from $98.3 billion in 2020 to $357.4 billion by 2028, at a CAGR of 17.4% according to a recent report by Fortune Business Insights. This upward trend highlights the importance of integrating advanced technologies in infrastructure projects to drive efficiency and sustainability.

In terms of innovation in construction techniques, the use of Building Information Modeling (BIM) has seen significant growth. The global BIM market was valued at approximately $5.2 billion in 2021 and is expected to reach $15.8 billion by 2028, rising at a CAGR of 17.2% (according to a valuation by Polaris Market Research). This shift allows Antin to manage projects more effectively, reducing costs and timeframes significantly.

Cybersecurity is a pressing concern in the infrastructure sector. The global cybersecurity spending in critical infrastructure is estimated to reach $222 billion by 2026, growing at a CAGR of 12.5% from $106.9 billion in 2022 (Statista). Antin Infrastructure Partners must address these vulnerabilities as they invest in digital technologies, ensuring that robust cybersecurity measures are implemented to protect sensitive data and critical systems.

Integration of renewable energy solutions has become a priority, with the International Energy Agency (IEA) indicating that global investment in renewable energy technologies is expected to reach $2 trillion annually by 2030. Antin’s involvement in renewable energy projects is manifesting through its investment in wind and solar power, expected to account for approximately 70% of new power generation capacity globally by 2025. This transition aligns with Antin’s strategic focus on sustainable infrastructure financing.

| Technology Area | Market Value 2021 | Projected Value 2028 | CAGR (%) |

|---|---|---|---|

| Smart Infrastructure | $98.3 billion | $357.4 billion | 17.4% |

| Building Information Modeling (BIM) | $5.2 billion | $15.8 billion | 17.2% |

| Cybersecurity in Critical Infrastructure | $106.9 billion | $222 billion | 12.5% |

| Renewable Energy Investment | Not specified | $2 trillion annually by 2030 | Not specified |

Utilizing these advancements not only enhances operational efficiency but also positions Antin Infrastructure Partners S.A. as a key player in the rapidly evolving infrastructure landscape. The emphasis on technological integration is vital for maintaining competitiveness and addressing the growing demand for sustainable and secure infrastructure solutions.

Antin Infrastructure Partners S.A. - PESTLE Analysis: Legal factors

Antin Infrastructure Partners S.A. operates within a highly regulated environment, particularly in the context of European Union (EU) infrastructure regulations. The EU has established various directives and regulations aimed at ensuring the safety, efficiency, and environmental sustainability of infrastructure projects. For instance, EU Directive 2014/23/EU concerning the award of concession contracts impacts how Antin manages its public-private partnership (PPP) projects. Compliance with these regulations is not just about legal adherence; it also affects project costs, timelines, and ultimately returns on investment.

Furthermore, Antin must navigate local zoning laws, which vary significantly across different jurisdictions. Compliance with local regulations is essential to avoid project delays and legal disputes. For instance, certain projects in France may be subject to the Code de l'Urbanisme, which outlines stringent planning and land use requirements. Failure to comply can result in costly fines or project cancellations.

Contractual complexities are another significant legal consideration, particularly for multinational projects. Antin frequently engages in transactions across various countries, necessitating the need for contracts that consider local laws and regulations. This sometimes includes negotiating terms that are compliant with the UN Convention on Contracts for the International Sale of Goods (CISG), as well as adherence to varying levels of regulatory compliance across borders. Such complexities increase both the duration and cost of projects, impacting overall financial performance.

Liability issues also pose a considerable risk in the infrastructure sector. Antin Infrastructure Partners faces potential legal challenges should infrastructure failures occur. This could pertain to structural failures or environmental damages arising from a project. According to the Construction Industry Institute, the average cost impact of construction defects can range from 1% to 4% of total construction costs, depending on the scale and nature of the defect. An analysis of various infrastructure projects indicates that the costs and legal fees involved could amount to millions of euros, underscoring the financial implications of legal liabilities.

| Legal Factor | Details | Financial Implications |

|---|---|---|

| Adherence to EU Infrastructure Regulations | Compliance with EU Directive 2014/23/EU | Potential project cost increase by 3%-5% due to compliance measures |

| Compliance with Local Zoning Laws | Subject to Code de l'Urbanisme in France | Penalty fees can reach up to €500,000 for non-compliance |

| Contractual Complexities | Navigating various international laws and regulations | Increased project duration and costs, averaging an additional 10%-15% of total budget |

| Liability Issues | Risks associated with infrastructure failures | Average costs for construction defects are 1%-4% of total costs; could total €1 million or more in severe cases |

In summary, Antin Infrastructure Partners S.A. operates in a complex legal framework that demands rigorous compliance with regulations and careful management of contractual obligations. These legal factors significantly influence business strategy, financial performance, and risk management practices within the company.

Antin Infrastructure Partners S.A. - PESTLE Analysis: Environmental factors

The impact of climate change on infrastructure planning is increasingly critical. Antin Infrastructure Partners S.A. focuses on projects that are resilient to climate-related risks. According to the Intergovernmental Panel on Climate Change (IPCC), climate change could lead to a rise in sea levels of between 0.3 to 1.1 meters by 2100. This necessitates adaptive infrastructure planning, particularly for coastal projects. A 2021 study indicated that globally, infrastructure sectors are responsible for about 80% of greenhouse gas emissions, emphasizing the need for sustainable development practices.

Emission reduction targets play a pivotal role in project design at Antin. The company implements strategies aligned with the Paris Agreement, which aims to limit global warming to below 2°C. For instance, Antin's recent projects in renewable energy aim to achieve a 30% reduction in emissions over their lifecycle. This includes investments in solar and wind energy that are projected to generate approximately 2,000 MW of renewable energy capacity by the end of 2025.

Resource sustainability is another key focus area. Antin emphasizes using sustainable materials in its projects. In 2022, approximately 60% of the materials used in Antin's infrastructure projects were sourced from sustainable sources, reflecting a growing commitment to environmentally friendly practices. The company aims to increase this to 75% by 2025, aligning with best practices in the industry for resource utilization.

| Year | Percentage of Sustainable Materials Used (%) | Projected Renewable Energy Capacity (MW) |

|---|---|---|

| 2022 | 60 | 1,200 |

| 2025 | 75 | 2,000 |

Environmental impact assessments (EIA) are crucial in the planning phase of projects undertaken by Antin. Regulatory requirements dictate that all large infrastructure projects undergo EIAs to evaluate potential environmental impacts. In 2022, 85% of Antin's projects completed a comprehensive EIA process, ensuring compliance with local and international environmental regulations. Antin is also committed to continuous monitoring and reporting of environmental performance throughout the lifecycle of its projects, aiming to minimize adverse impacts and promote biodiversity.

In Europe, for instance, the adoption of the EU's Green Deal mandates that projects must align with stringent environmental standards. This regulatory framework is projected to require an investment of approximately €1 trillion in sustainable infrastructure by 2030. These figures further underline the importance of adhering to environmental standards and the financial implications of failing to do so.

Understanding the PESTLE factors affecting Antin Infrastructure Partners S.A. provides crucial insight into the multifaceted environment in which the company operates. From navigating regulatory landscapes to embracing technological advancements, each element plays a vital role in shaping strategic decisions and future growth trajectories, ultimately guiding investors and stakeholders in making informed choices.